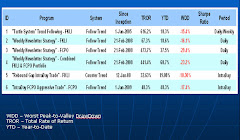

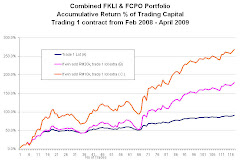

Performance:

Traders need to be very aware there is risk of loss in futures trading and that hypothetical, historic or actual results do not indicate future success.

Should you have queries, please contact me at martin.wong@cimb.com

2) Here is the entry for LONG FKLI Jul 09 @ 1073.5

3) Here is the exit for FKLI Jul 09 @ 1084 and 1093.5

Total profit on 1 lot @ +10.5 pts * Rm 50 = RM525 and 2 lot @ 93.5 +20 pts * RM 50 = RM1000.

2) Here is the short entry trading stmt Sell FCPO Sept 09 @ 2075.

3) The exit was EOD . We made a small profit +6 * 25 pts = RM150 (Closed out short trade at EOD at 2069).

2) Here is the entry to sell FCPO @ 2194 on July 2, 2009.

3) Here is the exit for FCPO @ 2141.

Here we have a good profit of 53 pts * RM 25 = RM 1,325.

2. Here is the stmt for the Short Entry @ 1047.5

3. Exit at 1039.5 with profit +8 * RM 50 = RM 400

1) Here is the entry - LONG FKLI June 2009 at 1069.

2) Exit at the end of the week - SELL FKLI June 2009 at 1076. Profit +7 pts = RM 350

Take profit i.e. buy to cover @ 2370 -> Gain +75 pts * RM 25 = RM 1,875.

Here is Short strategy for FCPO Aug 2009 at 2555 and take profit at S2 @ 2498.0

1) Entry for FCPO Jul 2009 @ 2671.

2) Exit FCPO Jul 2009 @ 2709. Profit +38 pts * Rm 25 = RM 950.

Here is the trading statement for the the above trade for our of my clients.

1) Entry FKLI May Contract @ 1011.5

2) Exit FKLI May 2009 @ 1029.0, Profit +17.5 * Rm 50 = RM 875

2) Exit : 24 April 2009 : SELL FKLI April @ 997 at EOD. Profit +21 pts * RM 50 = RM 1050.