2. Here is the stmt for the Short Entry @ 1047.5

3. Exit at 1039.5 with profit +8 * RM 50 = RM 400

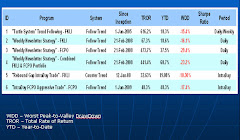

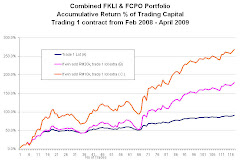

Performance:

Traders need to be very aware there is risk of loss in futures trading and that hypothetical, historic or actual results do not indicate future success.

Should you have queries, please contact me at martin.wong@cimb.com

2. Here is the stmt for the Short Entry @ 1047.5

3. Exit at 1039.5 with profit +8 * RM 50 = RM 400

1) Here is the entry - LONG FKLI June 2009 at 1069.

2) Exit at the end of the week - SELL FKLI June 2009 at 1076. Profit +7 pts = RM 350

Take profit i.e. buy to cover @ 2370 -> Gain +75 pts * RM 25 = RM 1,875.

Here is Short strategy for FCPO Aug 2009 at 2555 and take profit at S2 @ 2498.0

1) Entry for FCPO Jul 2009 @ 2671.

2) Exit FCPO Jul 2009 @ 2709. Profit +38 pts * Rm 25 = RM 950.

Here is the trading statement for the the above trade for our of my clients.

1) Entry FKLI May Contract @ 1011.5

2) Exit FKLI May 2009 @ 1029.0, Profit +17.5 * Rm 50 = RM 875

2) Exit : 24 April 2009 : SELL FKLI April @ 997 at EOD. Profit +21 pts * RM 50 = RM 1050.

* Please be aware these performance figures are hypothetical only, are in RM and show the results of trading 1 futures contract per signal. As the winnings continued, the money management is to parlay to trade more contracts as desired. If losing, reduce the number of contracts traded. Hypothetical results may under, or over compensated for the impact, if any, of certain market conditions, such as but not limited to, poor liquidity, poor execution, competitive or expensive brokerage etc. There are no guarantees these performance figures will continue to behave in the future as they have in the past and accordingly you should expect the worst draw down to be in the future and is therefore unknown. Traders need to determine, with or without the assistance of a licensed financial adviser as to whether future trading opportunities supported by these hypothetical performance figures are appropriate for them given their particular needs, financial situation and investment objectives. Traders need to be very aware there is risk of loss in futures trading and that hypothetical, historic or actual results do not indicate future success.